The stock market is going to crash. No doubt about it.

It will be spectacular. It will be painful. And most assuredly – IT WILL CRASH.

But that’s not a bad thing. (Also, it should not come as a surprise.)

Interested in Financial Independence and more freedom? Check out our FIRE series on YouTube. Subscribe to our channel!

People have been investing money for quite a long time, and during those cycles of investment also come crashes. It’s the nature of the market. As much as governments and central banks would like to completely remove downturns in the market, you can be 100% sure at some time in the future the market will crash – again, again, and again.

Stock market crashes are a normal part of the business cycle. Since the stock market is made up of all of those clever people trying to make money, it’s no surprise that it takes on a personality of its own with the following cycle that endlessly repeats:

- Clever people with ideas attract capital

- Capital is put to work creating businesses, opportunity, & profit

- Some people get greedy – creating risk (bubble)

- People panic – then comes a spectacular & swift crash (bubble bursting)

But then, what happens after the dust settles and people get bored and tired of being poor?

People get back to work. They build new businesses and adapt. Since there is already a foundation of resources and ideas to draw upon, they build upon that, creating the next business cycle that will grow larger than the last cycle because there’s already an established base that is building upon itself.

Reasoning the above, based on history and human nature, the following will always be true:

People, in general, will always look for ways to better their lives – whether that comes from starting a business, working as an employee for a business, or simply figuring out a niche for themselves that will create some kind of return.

As long as we haven’t reached a peak in resources (hit a resource ceiling), there will always be another business cycle. There always has and always will be assuming the creativity of human beings.

Barring a truly catastrophic event that wipes out most of the planet like a meteor impact or super-pandemic, you can bet on these facts.

(Btw, if that terrible event does happen, then it doesn’t matter where your money is, does it?)

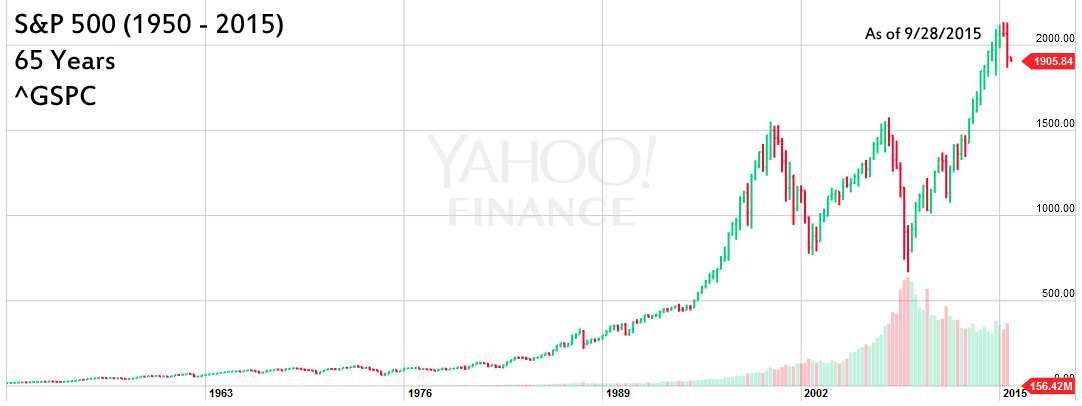

Historical Chart – S&P 500 Index

For a more recent historical perspective of the stock market, check out this quick chart from Yahoo Finance showing the S&P 500 for the past 65 years:

See all of those red bars?

Those are all of the times that entire S&P 500 went down. Some of them are very deep declines, marking what you would think of as a “stock market crash”. The bigger the bar, the bigger the crash.

But, if you take any 10 to 15+ year period where you’ve invested in the S&P 500 for the long haul and haven’t sold out – you’ve made a return. Depending on the year you started investing determines exactly what return you made, but you’re still in the black. Not only have you made a return, you’ve also been collecting dividends just for holding those stocks!

If you go back 20 or more years and were invested in the stock market, have you seen the return rate?

Ask yourself this question:

How could you have possibly lost money in some of the greatest returns ever?

Like Warren Buffett alluded to, you would have lost money if you danced in and out of the market like most people do, which is not the strategy that we’re going for. We’re thinking about this for the long-haul and even more importantly – broadly diversified across the entire stock market.

So think of stock market crashes as just a normal part of doing business. If you’re like me and invest in the long-term, you’ll rest much easier at night knowing that this is just the nature of the beast. But if you take the strategy of a short-term trader and you’re not a seasoned professional, you’re playing a fool’s game and are going to lose money in the long run.

Stocks are on sale when the market crashes! What a great time to rebalance into them from your bond portfolio. This is one of the reasons I think all investors (even youngsters) should have at least 10% of their portfolios in bonds. It gives you a ready reserve to rebalance into stocks when (not IF) the stock market crashes.

John